Adidas has hit a wall in North America, and this time it’s not because of Kanye West. The German sportswear giant reported a 5% sales dip in the region for the third quarter, blaming the fallout from the end of its once-lucrative Yeezy partnership and, more recently, the impact of President Donald Trump’s tariffs. Globally, though, Adidas managed to post a record €6.63 billion ($7.73 billion) in revenue. That’s a bittersweet achievement when your biggest market is suddenly wobbling.

CEO Bjorn Gulden didn’t sugarcoat the issue. “Retailers are very careful… So you clearly see that they want to buy less upfront,” he said during a call with journalists. American stores are nervous. They’re holding back, waiting to see what the tariffs will do to their margins and consumers’ wallets. Gulden added that widespread discounting was also dragging down Adidas’ full-price sales. “If you are at full price on a 100-euro shoe and the competitor is at 50% on a 200-euro shoe, then of course you will sell less.”

It’s not all doom and gloom, however. Adjusted for currency shifts, Adidas’ North American sales were technically up 1%, though still trailing Europe and Asia. The company’s global sales excluding Yeezy rose 12% in currency-neutral terms. “Even though the general consumer is not strong and there was lots of inventory in the market, still Adidas manages to grow well,” said Simon Jaeger, portfolio manager at Flossbach von Storch in Cologne.

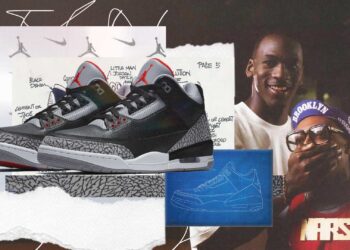

RELATED: Adidas Just Copied The Design Of Jordan’s Coolest 2025 Release

The tariff hit isn’t small — Adidas expects it to shave around €120 million off its operating profit this year, mostly in the fourth quarter. That’s actually an improvement from earlier projections of €200 million, thanks to a mix of price adjustments and clever supply-chain rerouting. Like many sportswear brands, Adidas has been shifting sourcing away from China and Vietnam to minimize the blow of higher import duties.

Of course, someone has to pay for those extra costs, and it’s not going to be the shareholders. Prices have crept up, especially on popular sneakers like the Samba, now retailing at $100 instead of $90. Gulden insists that consumers haven’t really noticed yet — but your bank account probably has. “The consumer reaction to our product and our price points was okay … but I think it’s too early to say,” he admitted.

Still, the brand isn’t sitting idle. Post-Yeezy, Adidas has ridden the wave of retro “terrace” sneakers (Samba, Gazelle, and Spezial) with colorful designs that appeal to both sneakerheads and nostalgia-hungry Gen Z buyers. “The Samba is still growing. I know people say it’s over, but it isn’t,” Gulden said. Yet even he knows a trend has a shelf life. The company’s running segment, bolstered by marathon-winning athletes and high-tech footwear, jumped 30% in the quarter — a sign that Adidas might finally be finding its stride again.

Still, the tariffs are casting a long shadow. With U.S. retailers ordering less and relying heavily on discounts, Adidas’ recovery remains a balancing act. A strong euro has already wiped €300 million off sales, and its shares are down more than 20% since January. Gulden, ever the optimist, says the company is focused on “transitioning well into 2026,” banking on upcoming events like the Winter Olympics and FIFA World Cup to reignite growth.

For now, though, Trump’s tariffs have clearly laced up Adidas. Will Trump’s own sneaker line be a good replacement?

RELATED: Jerry Lorenzo’s Fear of God x adidas ‘Athletics II’ Proves Minimalism Still Works