Puma just handed over a large piece of their company to China’s sportswear giant Anta, who picked up a 29% stake in the German brand in a new $1.8 billion deal (which basically values Puma at roughly $6.2 billion). That’s a very wild sentence to type about a company that once sat comfortably just behind Nike and Adidas as the world’s third-biggest sportswear brand. But here we are in 2026, and if we look back, PUMA has been in trouble for a while now.

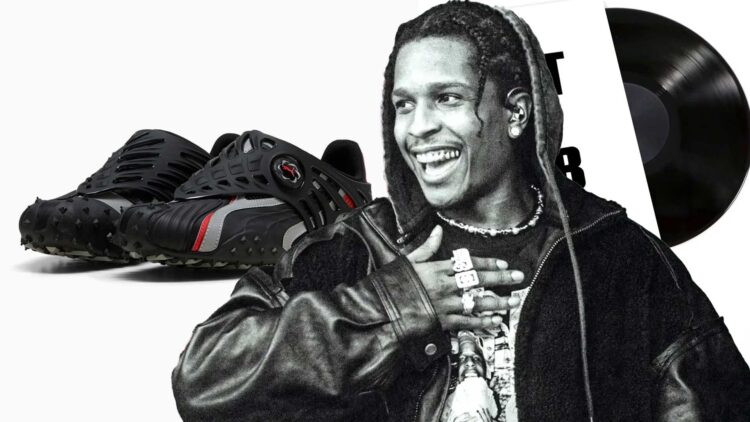

If you’ve been watching, this move probably doesn’t shock you. The brand locked down headline-grabbing partnerships with Rihanna’s FENTY line, A$AP Rocky, Formula 1, Mercedes-Benz, Hot Wheels, Marvel and even PlayStation in the last two years. And, on paper, that’s a dream lineup that should sell sneakers and clothing fast. In stores and on feet, though, things didn’t click or make sense to sneakerheads. And what followed was a lot of damage. Sales lagged because, let’s be honest, the heat just never arrived.

Some blame design fatigue. Puma leaned hard into the same silhouettes, then leaned again, then again. Over and over again. The Melo line turned into a colourway factory. New drops felt familiar in the wrong way. And how many collaborations did those sneakers get? TMNT. Fast & Furious. Rick and Morty. Scooby-Doo. Dexter’s Laboratory. And they all sat.

Others point to tech. Competing with Nike and Adidas takes deep pockets and constant R&D, and Puma hasn’t had the same firepower. Either way, the outcome stayed the same and, honestly, people stopped caring about new drops.

There’s a strange irony here, though. Puma and Adidas were born in the same house in Herzogenaurach, Germany, almost a century ago. Brothers Rudolf and Adolf Dassler built the original company, Geda, before a family fallout split the operation in two. Rudolf created Ruda, later renamed Puma. Adolf founded Adidas. Today, their headquarters still sit a short walk apart. One brand sprinted ahead, while the other tripped over Speedcats while Sambas took over the streets.

Morningstar analyst David Swartz summed it up bluntly: “Puma became … too dependent on maybe lifestyle products rather than performance sports shoes, which really drove this industry.” Less revenue meant fewer superstar signings. Meanwhile, newer players like On Running and Hoka ran straight past Puma without even looking back.

Even Puma’s own CEO, Arthur Hoeld, didn’t sugarcoat it. “Puma has become too commercial, over-exposed in the wrong channels, with too many discounts,” he said in October. Hoeld, who joined from Adidas and took charge in July last year, rolled out a turnaround plan soon after. It started with 900 corporate jobs cuts and a trim of the product range.

Now, Anta, the Chinese group, listed as 2020.HK, has taken a large piece of Puma’s pie. The brand has quietly built a reputation for sharp design and smart acquisitions over the years. Wei Lin, Anta’s global vice president for sustainability and investor relations, said, “We have a lot of insight how to make Puma more successful in China. It is one of the most valuable brands in this industry.” Investors clearly liked that confidence because Puma shares jumped up 9% after the news dropped.

Puma desperately needs fresh basketball energy, riskier silhouettes, and products that feel made for 2026, not recycled from last season. If Shaquille O’Neal can help drag Reebok back into relevance, there’s no reason Anta can’t do something similar here. Puma still has history, recognition and global reach. What it’s been missing is direction. This deal might finally give it one.

I mean com’on, how do you not sell sneakers when you have brand ambassadors like Rihanna and A$AP Rocky onboard?

RELATED: Wait, Why Is Steph Curry Wearing Kyrie Irving’s New ANTA Signature Sneakers?